Table of Content

With floating rates, the interest rate of the home loan will change. If the repo rate increases, then both the interest rate and EMI will increase. Similarly, if the repo rate decreases, then the interest rate and EMI will also decrease. So, to calculate the EMI using SBI Home Loan EMI Calculator, check with the SBI bank to find the current interest rate.

SBI offers home loans within the range of 10 lakh to 10 Crore . It is a straightforward tool that allows you to calculate SBI home loan EMI in advance on your home loan. You need to fill in your loan amount, tenure, and interest rate to calculate the EMI. Repayment will commence only after one year of course completion.

Document Information

As the number of EMIs continues to be paid, the interest rate and the principal amount will be reduced accordingly from the amount of the debt until the full amount of the loan is repaid. Loan terms are concurred by each party before any amount is lent. A debt may be backed by equity, such as a mortgage, or it may be unsecured, such as a personal loan. Revolving loans or lines of credit can be lent, spent and repaid, while fixed-rate, fixed-payment loans are fixed-term loans.

Loan amount- the EMI amount directly depends on the loan amount. If the loan amount is high then the EMI amount will also be high, and this can be checked using the online SBI Home Loan EMI Calculator. The minimum loan amount sanctioned by the SBI Home Loan is 25 lakhs, and the maximum amount is 7 crores. Refinancing involves replacing an existing mortgage with a new mortgage loan contract. SBI home loan EMI calculator, which other such calculators may not provide. The EMI calculator will show the EMIs based on the entered numbers instantly.

Financial Calculators

Dishonouring a check / ECS / NACH is a criminal offence which can be subject to fines under the applicable provisions of the legislation. You may be listed as a defaulter for not paying the EMIs on time. If, despite repeated reminders, you refuse to regularise your payments, the Bank can legally reclaim your vehicle or property.

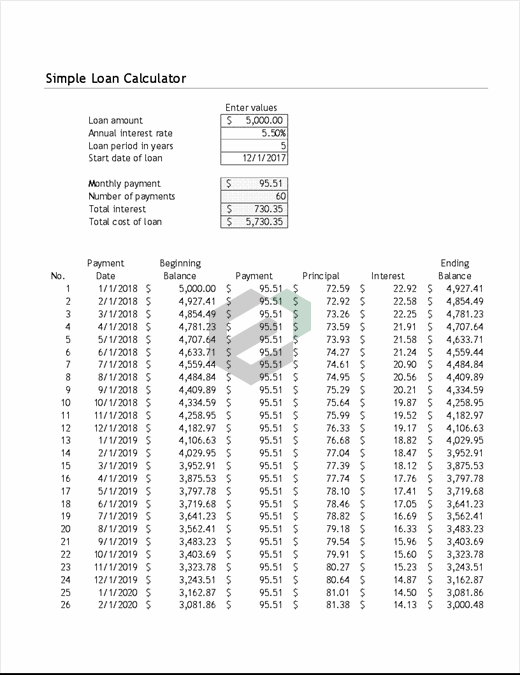

But for comparison purposes, use the SBI Home Loan EMI Calculator to compare various EMIs using different interest rates, loan amounts, and tenures. The SBI Home Loan EMI Calculator provides such an EMI amortization schedule. This schedule breaks down the entire repayment and the borrower can see if they can afford to pay the monthly EMIs.

Privilege / Shaurya Home Loan Calculator

Obtaining a Home Loan statement from SBI is a very simple process. You are just one step away from using Home Loan related services. SBI Frequently asked questions , has listed questions and answers, all supposed to be commonly asked in context of Home Loans. Please get answers to your common queries regarding the home loan, security, EMIs, etc.

In most cases, the amortized payments are fixed monthly payments spread evenly throughout the loan term. Each payment is composed of two parts, interest and principal. Interest is the fee for borrowing the money, usually a percentage of the outstanding loan balance.

Most financial institutions offer several payment frequency options besides making one payment per month. Switching to a more frequent mode of payment, such as biweekly payments, has the effect of a borrower making an extra annual payment. By clicking "Proceed" button, you will be redirected from SBI website to the resources located on servers maintained and operated by third parties. SBI doesn't take any responsibility for the images, pictures, plan, layout, size, cost, materials or any other contents in the said site.

The SBI Home Loan statement or Repayment Schedule is available all-round the year. You may download it online as per the steps mentioned above, or collect it physically from any SBI Home Loans branch as per their working hours. Magicbricks is only communicating the offers and not selling or rendering any of those products or services. It neither warrants nor is it making any representations with respect to offer made on the site.

You can use it to know the total interest payable and the total payment up to the loan’s tenure, along with instalment to be paid every month. The online SBI Home Loan EMI Calculator provides an accurate estimate of the EMI amount that needs to be paid to clear eth debt. Knowing this amount beforehand can help with planning the monthly budgets and see if the borrower will be able to pay the amount timely without any defaults. This is why it is recommended to use the SBI Home Loan EMI Calculator before getting the loan.

A loan is a type of borrowing by other individuals, organizations, etc. from one or more persons, associations or other institutions. The recipient incurs a mortgage and is generally obliged to pay interest on the loan before it is settled and to repay the principal amount borrowed. Loans are of many kinds, such as residential loans, auto loans, personal loans, student loans, corporate loans, and many more. In this guide, you can find all that you need to know about SBI loan repayments - how it works, how to pay the borrowed amount, amortisation schedule, terms and conditions and much more. Regarding the surplus balance of 5 – 10 lakhs that you are maintaining, this helps reduce only your book balance , it doesn’t reduce your drawing power directly.

The below table of the first 12 payments will make this clear. Calculate the remaining tenure to pay the outstanding balance- the borrower can use the outstanding balance of the loan to know how long they will have to pay the EMI to clear the debt. If the tenure still seems long, try transferring the outstanding loan balance to a different bank that allows repayment at lower rates. The EMIs of an SBI Home Loan is the fixed amount that the borrower needs to pay monthly till the entire loan principal amount is repaid. Many factors determine the loan amount and the EMI amount is calculated mostly based on the tenure, loan amount, and interest rate. Privilege Home Loans is an exclusive home loan product for government employees whereas Shaurya Home Loan is for Defense Personals.

The principal is the portion of the payment devoted to paying down the loan balance. Get the Home Loan Repayment Amortization Schedule monthwise for free. Find out your monthly EMI, Interest, Prinical and the monthly loan amount outstanding balance. You can just find all these details in our Home loan amortization schedule. The SBI bank does not charge any extra fees for opting for prepayment in case of a floating interest rate.

If so, then for a certain period you will be paying only interest on the entire outstanding amount, after which full EMI payments will start. If that’s not the case, then please contact your bank for more clarification on this. The home loan EMI calculator SBI on our website is available free-of-cost.

Regarding your query, yes, you can use the excel sheet to project approx EMI payments for full EMI payments. This column indicates that component of your EMI that has been spent on paying off the interest levied on your opening principal amount. Initially, each payment you make pays off more of the interest component than the principal amount but as time goes by, the reverse becomes applicable. This column indicates the date on which each loan payment is due. Generally EMI payments occur once a month, on the same day of each month, making it easier for borrowers to remember the payment dates.

No comments:

Post a Comment